Bank of America recently released its inaugural Small Business Owner Report, a semi-annual study exploring the concerns, aspirations and perspectives of small business owners across the country. The survey, which includes an oversampling of small business owners across the San Francisco market, uncovered that 52% of San Francisco small business owners surveyed are confident their local economy will improve in the next 12 months, versus 42% who are confident the national economy will improve during the same period. The report found that San Francisco small business owners are more confident in their local economy than any other city surveyed. Go SF!

“The report reveals a streak of optimism and slightly greater confidence among San Francisco small business owners when compared to the nation, but a number of economic factors continue to present challenges,” said Martin Richards, San Francisco market president for San Francisco. “Yet, despite the immense pressures they face and sacrifices they make, San Francisco small business owners remain confident about their future.”

Read on below for some interesting and eye-opening statistics (like the fact that entrepreneurs report owning a business as 4 times more stressful than raising children!) uncovered in this survey:

- 65% of San Francisco small business owners said that the local economy plays an important role in the success of their business

- 56% of SF small business owners said effectiveness of US government leaders was a top concern, far less than the national average of 75%

- 57% of SF small business owners anticipate an increase in revenue in the next 12 months

- 45% of SD small business owners cited increasing their marketing efforts to acquire new customers as the plan to help generate more revenue in the next 12 months

Small Business Owner Concerns

- Cost of Health Care – 66%

- Credit Availablity – 64%

- Recovery of Consumer Spending – 64%

Stressors for Small Business Owners

- Managing the Ongoing Success of a Small Business – 39%

- Raising Children – 11%

- Healthy Relationship with Spouse of Partner – 10%

Concerns Regarding Acquiring Talent

- Finding skilled employees – 27%

- Providing competitive salaries – 21%

- Providing competitive health care and retirement plans – 19%

Despite acknowledging the importance of attracting and retaining top candidates, 39% of San Francisco small business owners admit to not offering any type of financial benefits package to their employees.

Anticipated Hiring

- Small businesses anticipating hiring in the next 12 months – 24%

- Small businesses keeping staffing consistent for next 12 months – 58%

Need for Financial Expertise

- SF small business owners who consider themselves financially savvy – 27%

- SF small business owners who admit to needing occasional or ongoing financial assistance – 73%

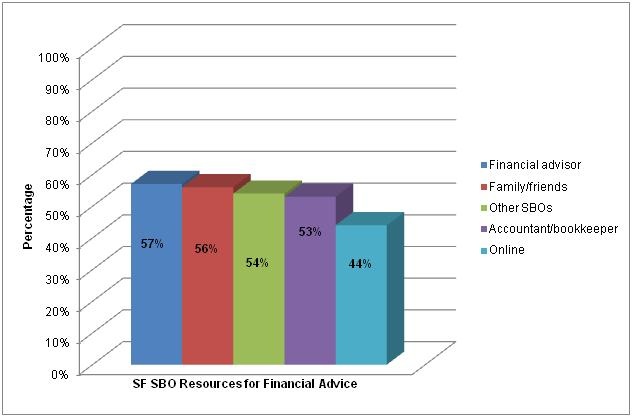

How Small Business Owners Acquire Financial Expertise

Small Business Challenges in Managing Cash Flow

- Not getting paid by clients and customers – 40%

- Low profits/lack of business – 29%

- Not invoicing customers in a timely fashion – 9%

Access to Capital

- Applied for a loan in the last 2 years – 45%

- Of those applied, how many were approved – 65%

We hope these stats were helpful and enlightening for both entrepreneurs and business advisors! For more information about the Bank of America Small Business Owner Report in San Francisco, click here.