In his recent article in the Huffington Post, PCV’s Ben Thornley, with Cathy Clark, and Jed Emerson provide an overview of the latest report from the Impact Investor project, A Market Emerges: The Six Dynamics of Impact Investing. Read the full article below.

With Cathy Clark, CASE at Duke, and Jed Emerson, ImpactAssets

As dozens of new impact investing funds are created explicitly to tackle the world’s most intractable social and environmental problems, including over 60 globally in 2011, best practices that lead to impact investing performance are more needed than ever.

A new report released today from The Impact Investor project, A Market Emerges: The Six Dynamics of Impact Investing, shows how impact investing is distinctive. The project, a partnership between CASE i3 at Duke University, ImpactAssets and InSight at Pacific Community Ventures, launched earlier this year in order to articulate the practices that lead to exceptional performance by impact investing funds with historical experience around the globe.

Our first project report, The Need for Evidence and Engagement, highlighted key project questions and market challenges for the field of impact investing.

While it is too early to reveal best practices, the second report shares findings from our extensive mapping of the global fund universe and in-depth conversations with over 35 limited partner fund investors, general partner fund managers, foundation managers, investment advisors and others about the unique relationships, challenges and questions experienced impact investors face.

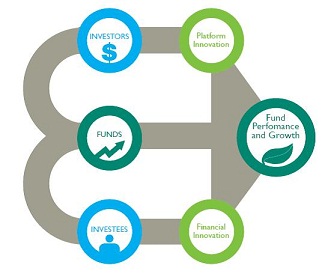

We organized the report around an ecosystem model of fund growth that explores the critical relationships among three primary stakeholders, two essential tools, and an ultimate success indicator. The Six Dynamics reveal unique relationships and challenges that impact investment fund managers face in reaping social and financial returns. The Dynamics are:

- The Active Investor: emerging relationships between limited partners and fund managers

- The Pioneering Fund: demonstrating resilience and creativity in the face of uncertainty

- Financial Ingenuity: deploying capital in creative and different ways

- Platform Influence: evolving investor access affecting fund structure

- The Performance Problem: demonstrating success through diverse performance indicators

- Aligning Purposes: bringing stakeholders together in common cause

Each Dynamic ends with a set of questions for further inquiry to define best practices, and a short case study that exemplifies the Dynamic.

In addition to releasing the report, The Impact Investor project is also curating a set of three panels on October 3rd at the 2012 SOCAP conference, designed to delve more deeply into three of the dynamics with leading practitioners in an open dialog format.