Our Access to Capital: Valuation 101 workshop is coming up on Tuesday, October 8th. Join us to learn what valuation is all about and how it’s calculated. Whether you’re thinking about your exit strategy, employee ownership or are simply curious to find out what your business is worth, you’ll leave the session with the tools you need to properly value the business you’ve built.

Below are the three expert panelists that will be sharing their knowledge and insights with us. We hope to see you on October 8th!

Spots are going fast! Register today: https://a2cvaluation101.eventbrite.com/

Use the code “A2CValuation101” to attend this event for free!

Michael Blum has more than 20 years of financial and management consulting experience. As a result, he has obtained significant experience in the valuation of companies, financial instruments and intangible assets, as well as in developing financial plans, business projections and valuations for venture-funded companies. Mike was a Director with the Valuation Practices at Financial Intelligence and at Pagemill Partners before co-founding Granite Valuations.

As head of Shoreline Pacific’s research department, Michael directed all research and structuring for over $200 million in placements for public and private companies, including valuation of companies and securities. Previously, he worked in KPMG Peat Marwick’s corporate transactions group, specializing in the valuation of companies, technologies and distressed instruments. Michael earned a BSE from the University of Pennsylvania and an MBA from the University of Chicago.

Ariel Jaduszliwer is Vice President of Pacific Community Management, an affiliate of Pacific Community Ventures. He is responsible for assisting in all aspects of the private equity fund including identifying, analyzing, structuring, and managing private equity investments. He also currently serves on the board of PCV portfolio company Adina. Ariel is a member of Kauffman Fellows Class 16.

Prior to joining PCM, Ariel worked as a management consultant for the Bridgespan Group, an affiliate of Bain and Company. While there, Ariel developed growth strategies for clients. He also advised the Gates foundation on its agriculture development strategy for sub-Saharan Africa and on its domestic education strategy. Ariel led the United Nations Development Program’s Growing Sustainable Business Initiative in Venezuela, which consisted of facilitating investments in businesses serving the base of the pyramid. Previously, Ariel worked in various capacities at Intel Corporation including manufacturing, pricing and strategic planning. In his latter role, Ariel ran Intel’s demand scenario planning process and managed a team of analysts responsible for aligning supply and demand across all microprocessor products. Ariel began his career at Neutrogena Corporation.

Ariel received an MBA degree from the Wharton School in 2007. He received his BS and MS degrees in Industrial Engineering from UC Berkeley and Georgia Tech, respectively.

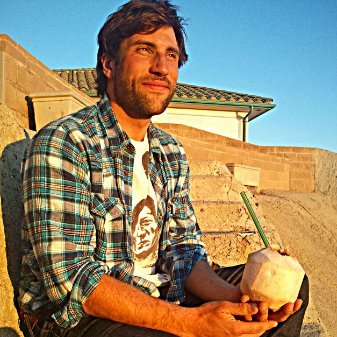

Kyle Parsons is a fellow entrepreneur and founder of Indosole. The idea for Indosole was conceived on a surf trip to Bali, Indonesia in 2004. Kyle and a couple of young Californians were struck by the environmental issues faced by Indonesians, and inspired by an unusual pair of sandals they found there. By combining these two things, they created a unique solution to the problem of pollution in Indonesia in the form of a product that was both fashionable and functional. Founder Kyle Parsons, will be speaking to us about IndoSole’s growth and valuation experience.