This is part two of a two-part series submitted by Chinwe Onyeagoro, CEO of FundWell.

In our last post, we talked about strategies for running a successful crowdfunding campaign, as told by Nikhil Arora of Back to the Roots. Back to the Roots is a sustainable foods business in the Bay Area that in 2012 raised $248,000 on Kickstarter to launch a new product, an aquaponics fish tank, or AquaFarm, that allows households to grow their own herbs. Nikhil’s experience shows how, with an effective marketing strategy and a compelling project, small businesses can leverage crowdfunding to access capital.

In our last post, we talked about strategies for running a successful crowdfunding campaign, as told by Nikhil Arora of Back to the Roots. Back to the Roots is a sustainable foods business in the Bay Area that in 2012 raised $248,000 on Kickstarter to launch a new product, an aquaponics fish tank, or AquaFarm, that allows households to grow their own herbs. Nikhil’s experience shows how, with an effective marketing strategy and a compelling project, small businesses can leverage crowdfunding to access capital.

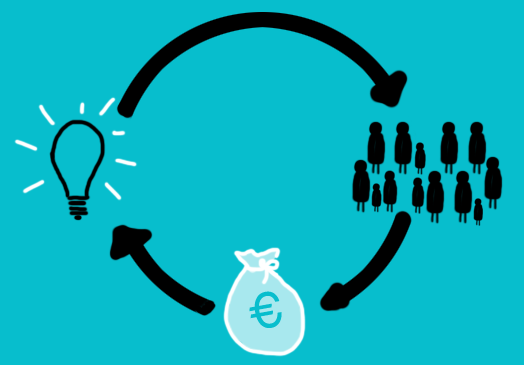

But that’s not all. In addition to the money provided by backers, crowdfunding can generate other, unanticipated benefits for small businesses. Two such benefits are 1) new customers and supporters, and 2) access to additional financing.

New Customers and Supporters

Everyone who contributes to a crowdfunding campaign is a potential new customer and loyal advocate for your brand. Not only are they likely to purchase from you in the future, they also are a source of great feedback. Nikhil says that Back to the Roots received thousands of comments on its Kickstarter website. “You get amazing feedback by putting yourself out there. It would have taken a year or two for us to get the amount of feedback we got in 30 days. In fact, we ended up delaying the launch of our product by a couple of months. We went back to the drawing board to implement our backers’ suggestions. In the end, we had a better product.”

Besides new individual customers, Back to the Roots also gained retail support through their crowdfunding campaign from Petco. “Before we launched the campaign, people said ‘no way’ to our idea. But crowdfunding validated it. Petco saw the momentum and success, and they were really excited. I mean, there aren’t a lot of innovations in aquariums these days. Now, we’re doing a 1,000-store launch in 2014.” Although this is an unusual scenario, it shows how a successful crowdfunding campaign can give your business great exposure. You never know what types of partners and customers will come out of the woodwork.

More Money

Before the crowdfunding campaign, Back to the Roots had some uncertainty about their AquaFarm product. It was expensive to make and they were not sure how well it would sell. Running a successful crowdfunding campaign provided the proof of concept they needed. According to Nikhil, “It gave us a better sense of the market size and a lot more confidence. You need that kind of validation when you’re making a brand new product.”

The Back to the Roots team raised $248,000 through their Kickstarter campaign. But, as it turns out, they still needed more capital. Roughly half of the money raised went to pay for the cost of the goods offered to backers. The rest of the money went to produce the molds for the new product. In order to scale and fully launch, they pursued debt financing options to round out their project budget. After the campaign, Back to the Roots could show lenders that they had a viable product and large potential customer base, as well as retail support from Petco. As a result, Back to the Roots was able to obtain $500,000 in financing from Fund Good Jobs. This capital covered the costs needed to fully launch the product line.

For small businesses, successful crowdfunding can open up financing options that may not have been accessible previously. Raising money from the crowd helps you improve your global cash flow and customer base, and it gives you a potential new source of collateral. It also makes you more attractive to lenders and investors if you’ve generated buzz and excitement around your business and product.

Conclusion

There are no guarantees when it comes to crowdfunding, and plenty of campaigns never get off the ground. If you decide to jump into the crowdfunding arena, know that it will take significant time and effort to reach your funding goal.

However, if you have the right story and strategy, crowdfunding can be a game-changing tool to help you meet your capital requirements, assess and spur customer demand, and gain access to new resources – and even more financing.