At Pacific Community Ventures we look for systemic-change initiatives that empower small business owners, underinvested communities, and the larger ecosystems that serve them. Opportunity Zones are a new tool to empower more capital to flow to underserved communities across America. We’re optimistic about the promise of Opportunity Zones – while staying cognizant of the unintended consequences of incentivizing investment in these communities.

What Are Opportunity Zones?

Opportunity Zones are a bipartisan community development program established in the Tax Cuts and Jobs Act of 2017 to incentivize investments in low-income communities across the country. The Opportunity Zones program is based on the bipartisan Investing in Opportunity Act, which was championed by Senators Tim Scott (R-SC) and Cory Booker (D-NJ) and Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI), who led a regionally and politically diverse coalition of nearly 100 congressional cosponsors.

Opportunity Zones represent a subset of census tracts with an individual poverty rate of at least 20 percent and a median family income no greater than 80 percent of the area median.

The program provides three forms of deferred capital gains taxes or tax breaks to incentivize patient capital equity investments in Opportunity Funds to seed new business investments, expand existing businesses, or fund real estate development in Opportunity Zones. Other than excluding a few “sin” businesses, investors are relatively unlimited in what they can finance. And the potential pot is huge – over $6 trillion dollars in unrealized capital gains could flow towards these communities from both individual investors and companies.

This is where much of the law’s guidance ended, so we’ve looked to leaders in impact investing, finance, state and local government, and community development to lead the way on ensuring Opportunity Zones create opportunities for those who need it most.

The Critical Importance of Measuring Opportunity

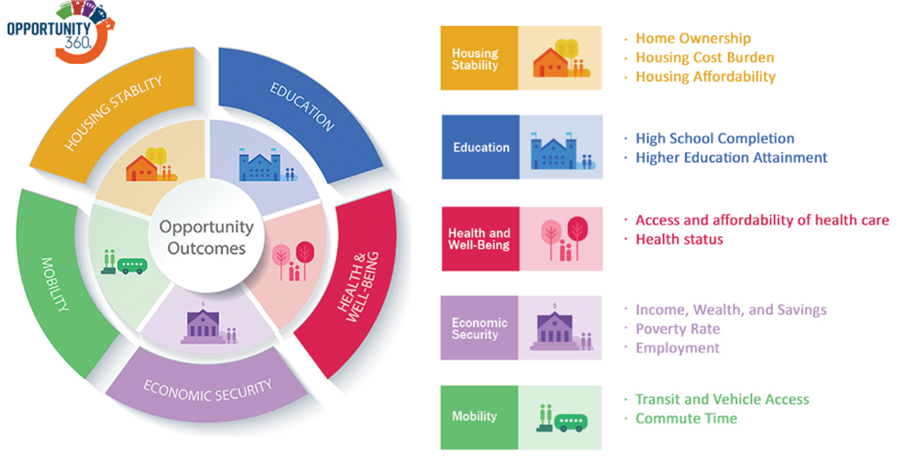

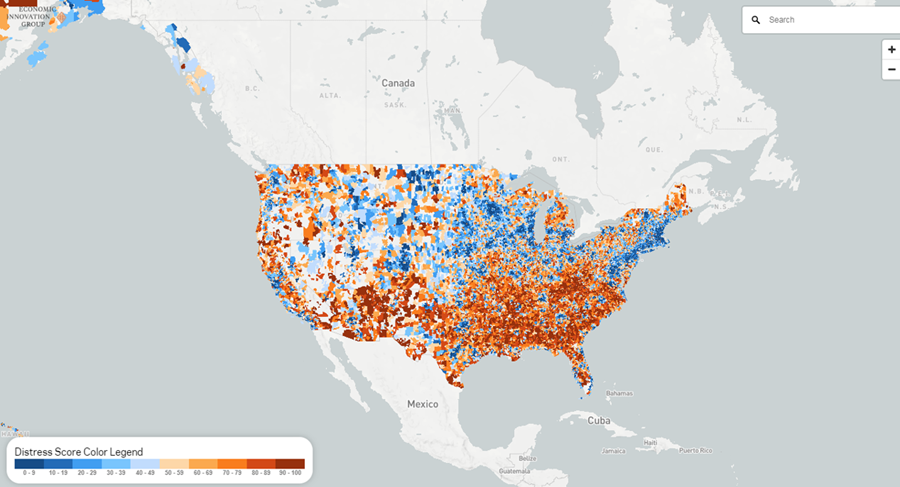

How do we know if we’ve selected the right areas, are enacting beneficial initiatives or are managing for impact along the way? Opportunity360 and the Distressed Community Index are two promising tools that have been highlighted for Opportunity Zone evaluation. Enterprise Community Partners created Opportunity360, which evaluates opportunity in a census tract across housing stability, education, health and well-being, economic security, and mobility and was used by several states in nominating their Opportunity Zones. The Economic Innovation Group – the same think tank that created the model for Opportunity Zones – developed the Distressed Community Index, which captures performance over time and across zip codes.

The seven component metrics evaluated in the index are poverty rate, median income ratio, prime-age adults not in work, housing vacancy rate, change in employment, change in establishments, and adults without a high school diploma. As the Urban Institute found following Opportunity Zone selection, these areas need investment. The median household income is $33,345, the poverty rate is 32%, and the unemployment rate is 13%. We appear to have selected the right areas – now we must ensure that we enact beneficial initiatives and manage for impact along the way — since we will certainly stumble, we must be open to learning and evolving.

Regulatory Guidance

The Economic Innovation Group has brought together the Opportunity Zones Coalition of public and private stakeholders to support the efficient and effective implementation of the Opportunity Zones program. Some guidance must come from government – so the Opportunity Zones Coalition sent the IRS and Treasury a letter requesting guidance of various aspects of Opportunity Zones and Funds. The U.S. Conference of Mayors also shared a similar letter, highlighting the need for such guidance. On Wednesday, Sept 12, the Office of Information and Regulatory Affairs, a division of the White House Office Management of the Budget, received regulatory guidance from the IRS for review regarding Opportunity Zones. This is expected to be released later in September.

A leader in interpreting tax code, Novogradac is hosting a 2018 Opportunity Zones Conference bringing together many of the early movers, including Kresge and LISC. Their plan is to offer tax guidance and clarification, including interpreting the forthcoming regulatory guidance. Novogradac has also developed has developed an Opportunity Zones Mapping Tool to show investors qualified Opportunity Zones.

Policy and Advocacy

Enterprise Community Partners has taken a leadership role in providing resources for creating Opportunity Funds; mapping, measuring and reporting; local government guidance; policy implementation; and advocacy for Opportunity Zones. Not only do they offer specific products and services, like Opportunity360, but they have policy and advocacy expertise to assist key stakeholders with the creation of Opportunity Funds and the implementation of Opportunity Zones.

Furthermore, they have committed to digesting guidance that comes through about Opportunity Zones, translating it, identifying gaps and calling for more information where necessary. Their webinars are a fabulous source of information should you want a primer on the space and to stay abreast of the latest policy initiatives related to Opportunity Zones – recently, Enterprise discussed critical issues from anti-displacement policies to updates from the Hill.

Moving Toward an Impact Framework

On July 19, the U.S. Impact Investing Alliance, the Beeck Center, and the New York Fed hosted a roundtable to begin the development of a shared impact framework for Opportunity Zone investment and the outcomes investors and communities are hoping to achieve. The convening brought together key stakeholders including community development investors, practitioners, researchers, and the sponsors of the original legislation. Discussion was fruitful, and several key themes emerged on how to ensure the shared impact framework benefits investors and end beneficiaries. These include engaging the local community, starting conversations about gathering impact data early, and ensuring there is transparency.

What’s Already Happening: Educating Communities and Early Movers

The Council of Development Finance Agencies (CDFA) is leading the charge on educating and preparing communities for the impact they will see. Their recent State of the States Opportunity Zones Report provides significant detail on the status of Opportunity Zones implementation, including where CDFA members are working in different Opportunity Zones and state-level break-outs of the Opportunity Zone efforts.

Notable early movers hoping to shape this new wave of community investing include Village Capital, Local Initiatives Support Corp. (LISC) and Access Ventures’ partnership with a planned investment vehicle of $100 million. This Opportunity Fund plans to invest in three to five cities in investments ranging from small businesses, commercial rental space and affordable housing. Enterprise Community Partners, mentioned above as a leader in Opportunity Zones and also an advocate and financier for affordable housing, is also launching a family of Opportunity Funds planned to unlock $1 billion over the next decade. Their first planned fund will target “Main Street” businesses in the U.S. Southeast. Page eight of Enterprise’s Aug 28 update includes more detail on early movers and their projects for Opportunity Zones as Enterprise believes that early movers will shape the markets in these communities.

Where We Go From Here

As we’ve seen from the terrific work being done by many players already mentioned, several best practices have already emerged – from engaging community beneficiaries to managing for impact to transparency to identifying policy gaps. We’re hopeful that many of the early players will also work to manage for impact in the communities they’re entering given their histories of community and beneficiary engagement, and we’re pleased to see the efforts of organizations like Enterprise to ensure that additional policy guidance is part of the conversation. We’ll maintain our optimism about Opportunity Zones and look forward to seeing the additional regulatory guidance in later September.

Take Advantage of Opportunity Zones

If your firm or organization is searching for advice on how to take advantage of Opportunity Zones for your own investment strategies, our team can guide you. Contact us to get started.