By Bulbul Gupta, President & CEO; and Casey Bell, Chief Impact Officer

One year ago, Pacific Community Ventures launched its Good Jobs Innovation Lab at the Clinton Global Initiative. We embarked on an ambitious Five Pillar Research Agenda exploring the intersection of restorative capital and business advising for low-income and entrepreneurs of color – with an eye toward driving wealth-building journeys for underestimated people and places, one good job at a time. Reflecting on the past year, we are humbled and exhilarated by the journey our team, and community partners have embarked on together, and the co-learning and field-building we’ve achieved in such a short span of time. Through our integrated model of combining affordable capital, pro bono business mentorship, and innovation lab research methods, PCV was able to deploy $10 million in capital in 2022, with 92% going to entrepreneurs of color and women and 98% going to low- and moderate-income communities, all while showing for the first time that 86% was deployed into historically redlined communities.

Our work could not be emerging at a more critical moment, as entrepreneurs of color face intersectional challenges: from inflation and recession fears that constrict the supply of affordable capital, to the rollback of Civil Rights legal precedents and corporate commitments that were meant to invest in them most. Historically excluded entrepreneurs, just building back from the chaotic COVID economy, face yet another cliff on the journey to building intergenerational wealth – many of the same families who experienced the decimation of half of Black wealth following the Great Recession.

These challenges are systemic – and threaten critical infrastructure within our economy – childcare, home maintenance, personal care, professional services. Small businesses are also invaluable incubators for groundbreaking innovation that our economy cannot compete without.

As we celebrate the One-Year Anniversary of the Lab, and PCV’s 25th Anniversary as an impact investor, we are deeply grateful to our founding sponsors and partners whose support enables PCV to do critical research and innovation for changemaking practices. We’re proud to share five key lessons learned in our first year, and a few thoughts on what is possible on the road ahead.

- It’s time to broaden the narrative on good jobs practice adoption.

“I’m gonna make a confession. For all of last year, I paid my managers more than I paid myself, and they will never know that.” – Pacific Community Ventures Good Jobs Entrepreneur 2023

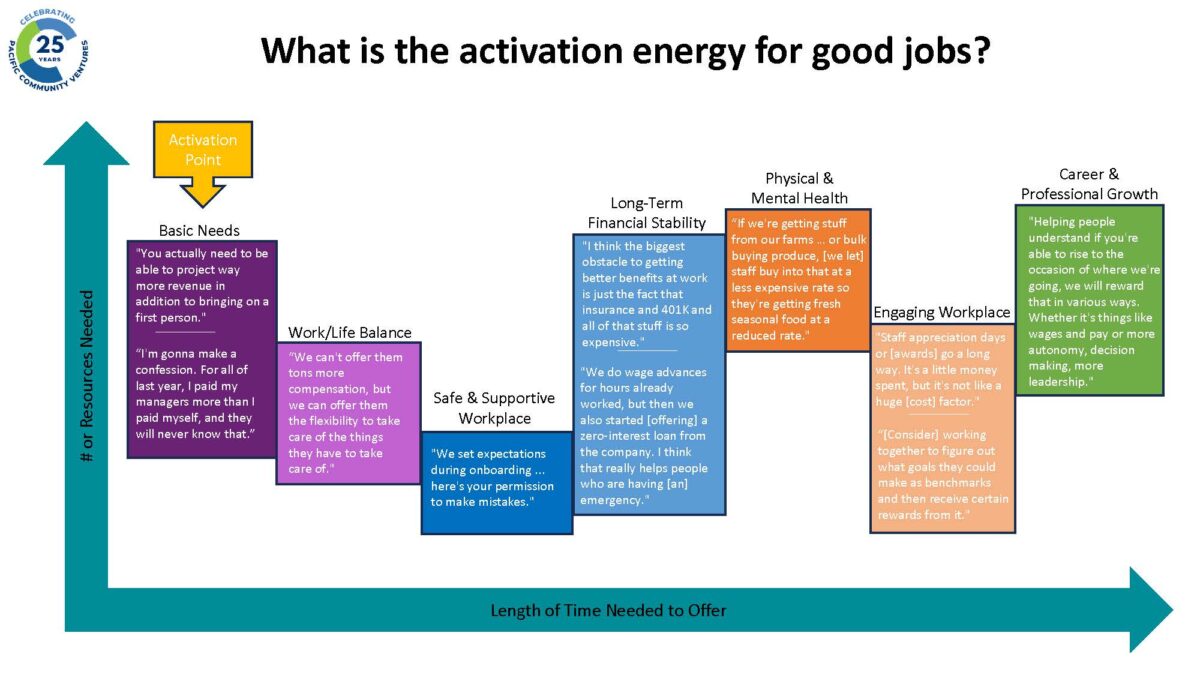

The majority of PCV clients express an interest in pursuing good jobs practices – and the most commonly cited barrier to adoption is cost. To further explore how to place good jobs within reach for entrepreneurs of color, PCV launched its Good Jobs Entrepreneurship Fellowship. The team engaged 14 entrepreneurs from our lending portfolio excelling at good jobs practice adoption relative to peers. Together, we co-created a leading edge learning community, and integrated an AI-assisted worker voice methodology, to explore barriers and opportunities for small business employers to adopt practices that best meet their employees stated needs.

A key, and surprising, theme that emerged is that while many of the fellows were highly aware of the need to offer good jobs to retain and engage employees, especially in light of 2022’s Great Resignation, and universally offered benefits access and two weeks PTO to their employees, many noted that the good jobs practices came at a high cost to their own journeys to financial freedom – a challenge which cannot be addressed through traditional technical assistance. Alongside our colleagues at Calidris, we leveraged our findings to isolate pain points and activation pathways for entrepreneurs adopting practices – with a forthcoming study slated for publication later this year. Broadening the narrative of good jobs practice adoption to ensure access to it – including for the entrepreneurs themselves – is essential.

We are also excited to partner with our colleagues at Financial Health Network to launch a Benefits Innovator Exchange to support product design and minimize customer acquisition costs for benefits innovators seeking to better support entrepreneurs of color.

- Revenue growth, and more importantly profits, are highly correlated with good jobs practice adoption – but not necessarily for the fastest growing firms.

In parallel to our fellowship program, the Lab implemented and leveraged a brand new Snowflake-enabled cloud data warehouse, and Tableau visualization system that enabled us to better track our client journeys over time – and enhanced our data-driven decision-making to better serve them. We created panel data tables to segment employer clients and better understand which types of businesses and community members are excelling at, and lagging in, good jobs practice adoption.

Perhaps unsurprisingly, profitability was the most significant factor – with profitable businesses 3.7x more likely to adopt good jobs practices. However, the fastest growing businesses were most likely to pause, or even lose, practices on their journeys. Moderate, sustainable growth is the ideal environment for good jobs implementation, and support is needed for “rocket ship” job creators who are struggling to prioritize job quality in real time. In 2024, we are excited to empower the Good Jobs advisors on PCV’s Business Advising platform with fresh insights and tools from this research to enhance post-investment mentorship outcomes for wealth building.

- The traditional impact frontier may understate the value of addressing systemic risks through restorative capital.

To amplify the impact of our restorative capital, team PCV piloted a new impact rating tool, and benchmarked our historic portfolio on our path to operationalizing real-time impact underwriting. When we looked across funds and products – we uncovered striking validation for the impact of our place-based Oakland Restorative Loan Fund. This fund offered 0% loans with no fees to clients as PPP sunset late 2021 into 2022 – and provided timely, critical support to sustaining dozens of businesses. This impact was achieved, however, through a 1-point loss in financial return. Nevertheless, the fund structure still provided its anchor investors with a modest return.

Intentionality in community co-creation was the “secret to success” in reaching 100% entrepreneurs of color, and female-identifying entrepreneurs at a critical moment. Without this impact-first type of investment, and slight trade-off in financial return, entrepreneurs of color within our portfolio would have undoubtedly fallen off yet another economic cliff. Moreover, we saw that other impact investments offering a higher financial return but contain a different impact profile (i.e., agnostic to social equity outcomes) risked minimizing racial equity on the traditional impact frontier.This recognition is leading us to explore what a balanced portfolio needs to look like for an impact-first CDFI, and define what we need from our impact investors in this inflationary environment to drive impact without leaving historically underestimated communities behind, once again.

- A continuum of capital is critical to address systemic change – like the climate crisis – without broadening wealth gaps.

At the Clinton Global Initiative meeting this year, PCV plans to announce its Good & Green Jobs strategy and Climate Justice Mobilization Fund for BIPOC-led construction, general contracting, and engineering firms as an expansion of our existing commitment that launched the Good Jobs Innovation Lab. With the federal government poised to make historic investments in addressing the climate crisis through the Inflation Reduction Act and Greenhouse Gas Reduction Fund, these well-intentioned dollars, while in a position to improve communities, may very well end up worsening racial wealth gaps. Communities who are often already better resourced tend to be able to leverage larger inflows of investment, while a lack of ownership rooted in the practice of redlining sets communities of color on the back foot.

Policymakers traditionally think of the levers for equitable climate technology deployment to be (1) capital availability and (2) workforce readiness. This approach misses a key element to ensure that energy projects are developed in community, by members of the community, for members of the community – where economic benefits can be recognized by the community long-term.

Construction-related businesses are predominantly small, 98% have fewer than 100 employees. They face industry bias in accessing capital and for smaller contractors, it is difficult to grow sustainably. There is a seasonality component to cash flow which creates a perceived lending risk. Construction related projects vary widely in scope, size, timeline and a host of other factors–all of which are challenging when using traditional underwriting guidelines designed for a loan product rather than a specific project.

PCV’s Climate Justice Mobilization Fund is poised to lend truly flexible Mobilization Capital which will include extended interest only periods, principal payments coinciding with project payout as well as balloon payments as needed. Our Business Advising program is also actively seeking partners to support our clients along their journey to full participation in the climate economy.

- A data-driven culture starts with putting the needs of people ahead of practices and technology.

Finally, the work of the Lab could not be possible without our investment in data modernization, and perhaps more importantly data governance. A key to our success has been convening a cross-functional data working group responsible for capturing user needs to activate data-driven decision-making along our theory of change. In 2024, we are eager to share our data maturity and impact management process and templates to fellow CDFIs and community-based organizations to magnify our shared impact for underestimated communities.

Join our network and celebrate 25 years with PCV!

25 years ago PCV was founded as one of the country’s first impact investors, and there is exciting work ahead for us. As our impact grows, so too does our community, and we are excited to continue connecting, teaming and growing with others on this journey. We invite you to join us in our efforts, and become part of our mission as we celebrate 25 years of IMPACT:

- Sponsor PCV’s 25th Anniversary and join our community celebration on November 11, 2023 in Oakland!!

- Invest in PCV’s Restorative Capital Fund and Entrepreneurs.

- Volunteer your time as a Small Business Advisor.

- Sponsor our Good Jobs Research Agenda.

Thank you to the Good Jobs Innovation Lab’s founding supporters and partners who have made our work possible: