Case Studies

Community Housing Capital

One CDFI’s Journey To Effective Impact Measurement and Management

Community Housing Capital (CHC) is a national nonprofit and Community Development Finance Institution (CDFI), based out of Atlanta, that aggregates loan capital to finance the creation and preservation of affordable housing. To fulfill its mission, CHC provides predevelopment, acquisition, construction, and permanent financing on multifamily and single-family developments to NeighborWorks Organizations. CHC can provide this financing by leveraging grant funds from NeighborWorks America and the CDFI Fund, along with private-sector debt capital from banks and socially motivated investors. This public and private collaboration allows CHC to provide the flexible, attractive financing options that these complex projects require. Since 2000, they invested $720 million in direct loan originations and leveraged $2.3 billion in affordable housing development creating over 1,200 jobs – all while generating a return.

Community Housing Capital (CHC) is a national nonprofit and Community Development Finance Institution (CDFI), based out of Atlanta, that aggregates loan capital to finance the creation and preservation of affordable housing. To fulfill its mission, CHC provides predevelopment, acquisition, construction, and permanent financing on multifamily and single-family developments to NeighborWorks Organizations. CHC can provide this financing by leveraging grant funds from NeighborWorks America and the CDFI Fund, along with private-sector debt capital from banks and socially motivated investors. This public and private collaboration allows CHC to provide the flexible, attractive financing options that these complex projects require. Since 2000, they invested $720 million in direct loan originations and leveraged $2.3 billion in affordable housing development creating over 1,200 jobs – all while generating a return.

There’s a critical shortage of affordable housing for seniors in the rural farming community of San Luis, Arizona. Some estimates have put the shortage in excess of 1,000 units so it comes as no surprise that the new Las Brisas Apartments in San Luis — all completely affordable for seniors and designed in accordance with sustainable design principles: solar panels, energy-efficient appliances, and low-flow faucets — already have a 100% occupancy rate and a waiting list. With such an obvious need, one might think the market would enable construction of apartments like Las Brisas in droves. You’d be wrong. The Las Brisas project will pay for itself and then some, but it doesn’t have the appeal of a luxury condo building in New York or San Francisco, and the developer, Comite de Bien Estar, needed flexible financing during the predevelopment stage to get the project off the ground.

CHC’s flexible financing played a critical role in the success of this 60-unit project, particularly during the predevelopment stage: “We needed operational money just to get to the starting line, so CHC played an important role in getting the project off the ground. We used it to pay the application fees and fees to the state, which let us set up everything for the actual construction closing,” said Gary Black, Deputy Director, Comite de Bien Estar. The Las Brisas project is just one example among the more than 450 investments to date that CHC has made in 142 communities across the country.

Laying The Groundwork: The Impetus for a Social Impact Measurement Initiative

While CHC has exhibited consistent growth for 15 years, creating tremendous social and environmental impact in communities across the country, most of their leadership and staff never thought about CHC’s value proposition beyond ” providing financing for affordable housing.” Since the end of the last recession, the number of funding sources available for “affordable housing” has decreased. CHC realized that, to fuel sustainable growth, they were going to have to look outside their traditional sources of capital; for example, the potential decrease or elimination of CRA funding due to recent tax changes could have serious implications unless they diversified. CHC knew that diversity of equity sources and debt capital would provide a more balanced financing model that would enable their ability to continue scaling.

Angie Waddell joined CHC five years ago and, unlike most of the CHC team who came from traditional banking backgrounds, had worked in the nonprofit field. Though CHC had been collecting data on the projects over the years, there was always the challenge of how to best use the information. As CHC talked about the need to diversify its sources of capital and the best platform for measuring and managing impact data, Mrs. Waddell was a natural fit for leveraging their 15 years of investment data to help prove and improve the social and environmental outcomes of their investments in addition to financial ones – to make their investments even more impactful and to make the case to new kinds of funders.

Eager to ensure the data’s integrity, Mrs. Waddell enrolled the help of PCV after she serendipitously sat next to PCV’s President and CEO, Mary Jo Cook at a CDFI conference and learned more about the organization’s impact consulting expertise. Part of presenting the idea of partnering with PCV to CHC management was explaining the value add of social impact and that working with PCV was like an S&P Rating or a “Good Housekeeping Seal of Approval” in the world of impact. CHC hoped that developing a rigorous, credible approach to impact measurement and management would enable them to communicate the social benefits of their lending more effectively and attract the interest of a more diverse set of investors.

Weaving Impact Into The Fabric of CHC

Financial and impact numbers from 2017

While CHC’s initiative began with a quest to better use their data to show impact, they also levered PCV’s expertise to develop a comprehensive impact measurement and management (IMM) system to support the organization in increasing impact and communicating that impact externally. CHC and PCV’s work together included the development of a logic model, overarching recommendations for IMM systems and processes, the development of an impact due diligence tool, the identification of appropriate impact metrics, and the development the organization’s inaugural impact report. Together, these workstreams are enabling CHC to clearly articulate how the organization’s activities contribute to its desired social impacts, further refine strategies to increase the organization’s impact, and attract additional funding from a range of impact investors.

The first order of business was coming to an agreement around impact objectives and developing a logic model. When CHC began working with PCV, CHC struggled to articulate a common vision around the organization’s intended impacts. PCV led internal discussions to understand staff members’ perceptions of what their organization’s impact was, and to develop consensus around their impact goals. After codifying CHC’s impact goals, PCV developed a logic model that demonstrated how the organization, its capital, and its activities tie to the long-term change the organization wanted to affect in the communities they work in. Developing a logic model not only helped CHC more clearly articulate the connection between its activities and targeted long terms impacts externally, but also laid the groundwork for the organization’s impact measurement and management system.

Data isn’t helpful unless you know what you’re trying to use that data to achieve. As part of the collaboration, PCV helped CHC identify the right set of impact metrics to measure the organization’s progress in alignment with its objectives. CHC had the groundwork upon which to build a robust evidence base that would help the organization better understand, increase, and more effectively communicate its impact; but the logic model served as a guiding principle.

To support CHC in increasing impact in alignment with its objectives, PCV worked with CHC to develop a quantitative impact due diligence tool, which the CHC team will incorporate into underwriting and assessing what positive social impacts they expect an investment to have. CHC’s impact due diligence tool evaluates each investment opportunity based on its anticipated impact on investees, beneficiaries, and communities; this framework helps the lending team at CHC, especially those with finance backgrounds who typically focus on the financial risks of potential loans, to consider nuances to a loan’s expected positive impact that they previously had not assessed. The tool is expected to help CHC increase the impact of the organization’s work by providing an objective evidence base to systematically prioritize loans with a greater anticipated impact. The tool is also expected to help CHC attract additional capital by signaling the organization’s thought leadership and commitment to impact.

After aligning on impact objectives and developing a logic model, PCV and CHC looked at the organization’s existing approach to impact measurement and management. During this phase of work, PCV introduced a broader set of the CHC team to the nuances of IMM, recommending tools and processes that would help the team more effectively understand and communicate its impact. Throughout the project, Mrs. Waddell reported that bringing the staff along during the process was the most challenging for her — and longest – phase: “Team members are supportive and working hard to understand what all this impact work entails. It’s hard to grasp a logic model — metrics are easy, but the semantics are all new. Our board and our management really see the benefit of having it as we grow as a CDFI.” Their commitment to this system is evidenced by reorganizing some of staff’s responsibilities to allocate half of Mrs. Waddell’s capacity to continue supporting CHC’s IMM system. Mrs. Waddell maintains that it’s often easier to have an external expert guide a process like this since they can ask hard questions to leaders and staff at all levels, and this phase of work was a great opportunity for PCV and Mrs. Waddell to do so.

Supporting the Organization’s Financial Sustainability

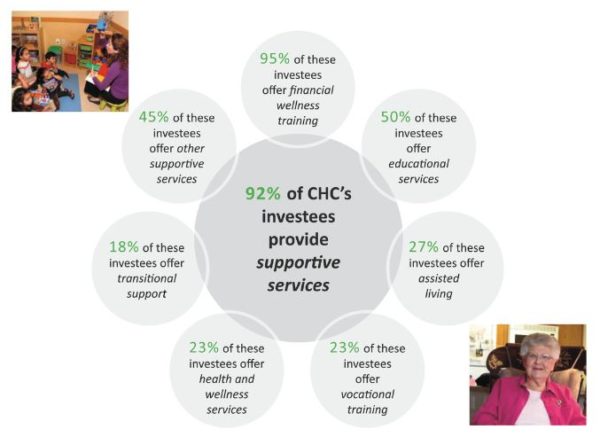

In addition to supporting the development of CHC’s IMM system, PCV partnered with CHC to develop the organization’s inaugural impact report. This impact report, which drew from the organization’s impact data, has helped CHC communicate affordable housing’s broad-based benefits to a diverse set of stakeholders. CHC will vastly expand the universe of potential investors they can approach, and they can more concretely demonstrate how investments in CHC are investments in community health and wellness, in keeping existing properties on the market, and in providing stability to families and children.

By the end of 2019 CHC expects to have fully implemented a streamlined approach where mission and vision are tied closely with their funding priorities, impact, and lending. “This process has helped us realize more of what we’ve been doing. I’m excited to provide this as a betterment for our own borrowers as well, to help them understand their own impact.” In addition to strengthening the organization’s lending activities, the impact measurement and management system is bolstering CHC’s development efforts, Mrs. Waddell noted that: “We knew we had to have an IMM system in place that aligns with impact investors’ objectives and stood up to scrutiny. Our dollars do more than create housing units, and conversations with other potential funders are starting to evolve since PCV’s first phase of work. It’s been a game changer when it comes to development. We are optimistic that this work will help CHC continue to play a more impactful role in the communities where the organization invests.”