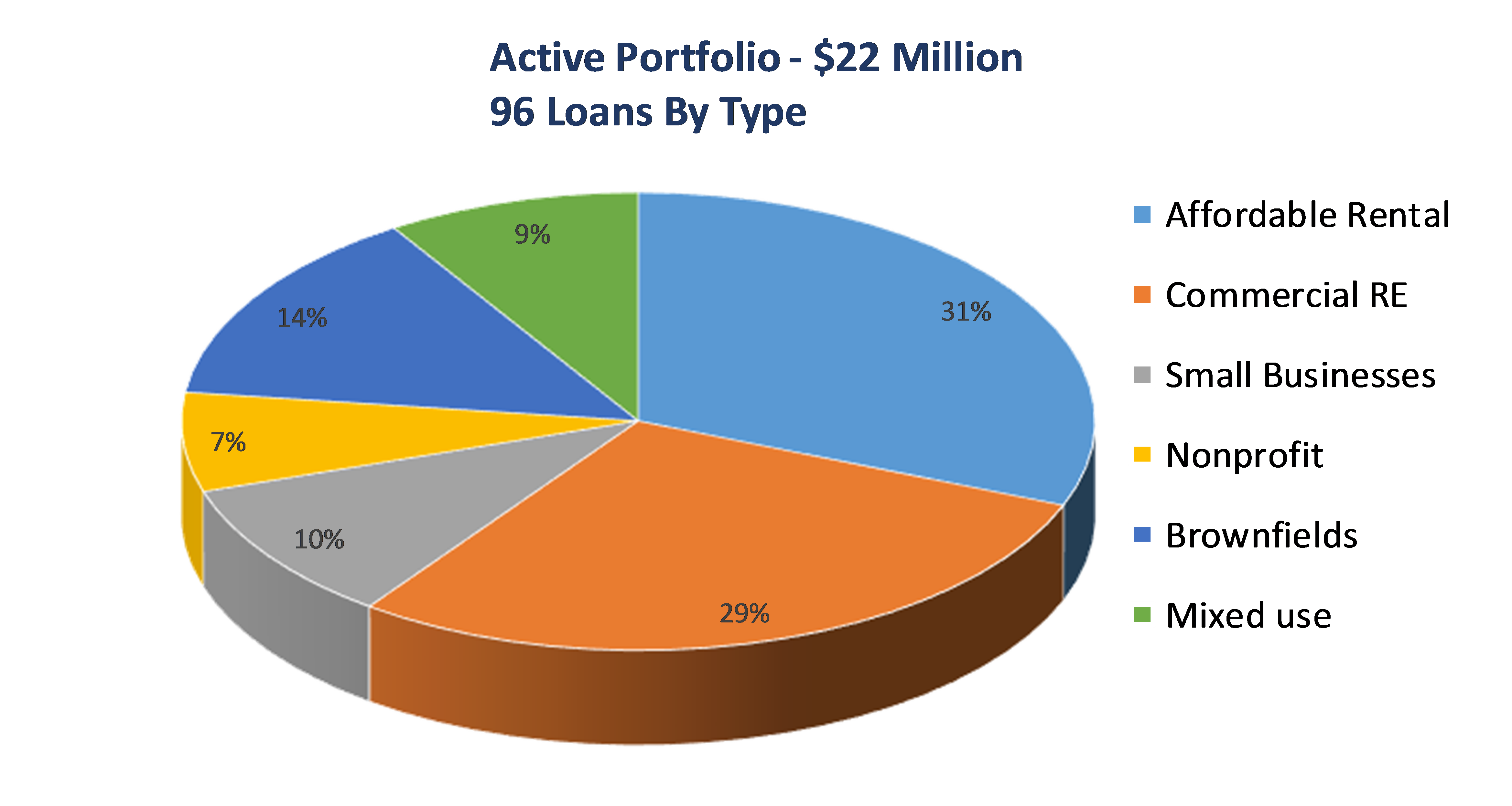

Carolyn Gonzalez, head of business development at the Community Capital Fund (CommCap), knew that for her organization to survive it had to diversify its funding base. But in every meeting with potential investors — foundations, banks, and government lenders— she kept hearing iterations of the same question: “How did CommCap know if it was actually achieving anything?” Carolyn and her team knew that CommCap, a $22 million community loan fund, was doing critically important work in the Greater Bridgeport area of Connecticut. Bridgeport had been hit hard by the decline of the manufacturing industry over the past four decades, and was in real need of economic revitalization. Positive social impact, Carolyn knew, was inherent to every loan they made to nonprofits, small businesses, and property developers. They had case studies and some portfolio-level data to prove it, but prospective funders wanted more. She also believed that this additional information could potentially inform CommCap’s lending strategy. But, how, Carolyn questioned, could something as ephemeral and subjective as social impact be rigorously measured?

Working with PCV

Carolyn’s search for a consultant led her to PCV, an organization who could help them understand the market landscape for impact measurement tools, and develop an evaluation system that could be integrated in their existing data collection systems. Carolyn liked that PCV was a fellow community development financial institution (CDFI) that had direct experience with measuring the social impact of businesses that received investments and advisory support. PCV InSight was also interesting because we’d provided impact evaluation and consultative support to institutional investors and foundations — just the kind of funders who CommCap hoped would invest in their loan fund.

Our staff visited CommCap’s headquarters in Bridgeport in January 2014. PCV InSight and CommCap staff took a step back from the specifics of the project, and asked a broader question: What, really, is CommCap trying to do? How successful, in the team’s candid view, has CommCap been at achieving this objective? This sparked a larger philosophical discussion covering the challenges to identifying the effects of your actions, and to taking credit for the actions of borrowers and advised businesses. From there, we learned more about CommCap’s model, its strategic plans, and existing data collection processes.

Our Impact Measurement Recommendations

Using the day-long working session in Bridgeport as a guide, our team developed a set of recommendations for CommCap that covered all aspects of implementing an impact measurement system and sharing key findings with staff and stakeholders. This included detailed sets of metrics that CommCap could use to measure the historic impacts of the businesses, nonprofits, residential and commercial developments and brownfield projects they had financed, as well as the small businesses they offer technical assistance through a program called The Link. PCV InSight developed survey templates that CommCap could use to collect information from borrowers, which would help CommCap establish a baseline of current impact – e.g., the number of female staff at businesses in the current portfolio – that could be tracked over time. This would allow CommCap to answer the critical question, “Are we getting closer to our goals?”

We also provided recommendations regarding the approach CommCap could take to survey borrowers and integrate findings into Portfol, CommCap’s portfolio management system. The PCV InSight team offered suggestions on approaches CommCap could take to feature its findings on its website, through outreach to potential partners, and via conferences and annual reports. We believe that the fundamental challenge of impact measurement is striking a balance between rigor and ease of implementation, and so we offered additional measurement approaches that CommCap could adopt after successfully implementing their first impact measurement system.

Implementation and Findings

CommCap knew that if it wanted to collect impact data that was in any way useful, it would need to get all – or at least most – of the organizations it financed and advised to participate. This would require a concerted effort, and the small staff was already at full capacity. So CommCap decided to bring on Fred Tencic, a former hedge fund professional, to lead the data collection effort. Fred’s tenacious efforts, which involved surveying borrowers in person and over the phone, resulted in CommCap’s collection of data from 70 percent of its borrowers.

CommCap knew that if it wanted to collect impact data that was in any way useful, it would need to get all – or at least most – of the organizations it financed and advised to participate. This would require a concerted effort, and the small staff was already at full capacity. So CommCap decided to bring on Fred Tencic, a former hedge fund professional, to lead the data collection effort. Fred’s tenacious efforts, which involved surveying borrowers in person and over the phone, resulted in CommCap’s collection of data from 70 percent of its borrowers.

When the dust had settled and CommCap had tallied up all of the survey results, Carolyn learned some surprising things about their work. One of the more impressive findings, in her view, was the fact their borrowers had done business with over 400 businesses in the city of Bridgeport. Even if the number of businesses they financed was smaller, this larger number reflects the numerous indirect, positive economic effects that supporting small businesses can have in a community. CommCap also learned that most of its borrowers weren’t able to find financing elsewhere, as nearly two-thirds had previously been ineligible to obtain other loans. These findings reaffirmed the team’s view that CommCap was providing essential contributions to Bridgeport’s economy.

Carolyn also reflected on some challenges highlighted by their findings. “The project confirmed some things that CommCap wasn’t all that thrilled about. We saw that not many of our businesses are women- or minority-owned. We were aware of this, but seeing the aggregate data really clarifies our thinking about the portfolio. Additionally, like many CDFIs, we lend under the assumption that loans made to businesses in low- to moderate-income communities help to employ residents from those communities. And that wasn’t the case for many companies in our portfolio. Most employees of businesses we financed in Bridgeport were from out of town. A majority of employees of financed nonprofits, however, are Bridgeport residents.” Carolyn explains that while CommCap would prefer to support jobs for Bridgeport residents, there are substantial benefits to bringing workers to Bridgeport. “Supporting businesses that employ people from out of town is still aligned with our mission, because these people spend money in our community.” Nonetheless, Carolyn and her colleagues believe these findings will inform the organization’s lending strategy going forward.

CommCap’s Recommendations For Other CDFIs

CommCap came to the following conclusions based on its experience managing the impact data collection project, and they have several recommendations for other CDFIs attempting to implement similar systems.

- It’s ideal to track impact metrics that align with industry standards but you need to pay very close attention to your capacity to get data.

- Collect Data over Time: Going back is great, but going forward is better. You’ll want to track this information over time, not just retrospectively.

- Establish a Baseline: Be reasonable and practical. Assess your capacity to maintain new information over time.

- Surveys are valuable tools to capture data not previously collected and to update existing data.

- Intake and Reporting: Change your application documents, loan documents, and policies to include the collection of this data as a requirement for borrowers.

- Portfolio Management System: CommCap uses Portfol. Their goal is to add new fields to keep the new metrics, and determine to what degree the system can be upgraded.

- Annual Data Collection: Don’t overburden borrowers or staff. Make annual surveys or other data collection processes part of a scheduled routine that has a beginning and an end.

We’re looking forward to seeing CommCap continue to add to its impact measurement capabilities so it can better serve its borrowers and share the impact of its work more widely with key stakeholders. If you know of a fellow CDFI that’s looking for support or insight into measuring its own impact, we’d love to hear from them.